Buying a Home After Military Retirement

by Becca Stewart - September 8th, 2022

For many military families, retirement is a bittersweet prospect. After 20 years or more in the service, it’s time to re-enter the civilian world. Deciding where to live after military retirement can be a difficult choice. No matter where you land, here’s what you need to know about buying a home after military retirement.

Military retirement timeline

Military retirement is a process, not a one-time event. You can read more detailed information via Military OneSource, but here is the basic military retirement timeline for all service branches:

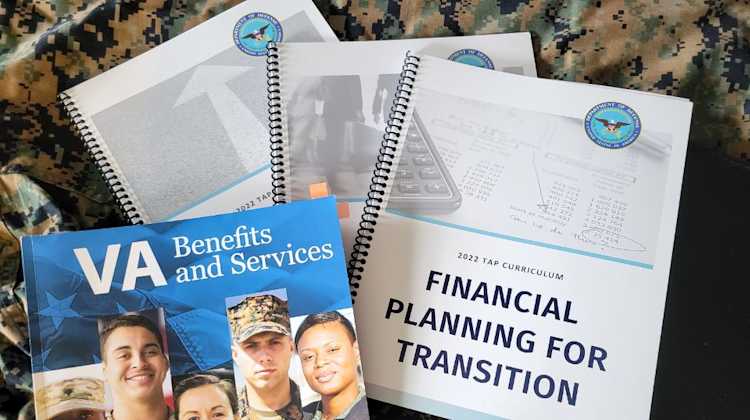

12-24 months before retirement: Start by contacting your installation’s Transition Assistance Program (TAP) office. You must attend a pre-separation TAP briefing at least 365 days before your final day of service (you can schedule this briefing up to 24 months before separation).

12 months before retirement: Formally submit retirement request and fill out DD Form 2648. (This timeline varies for each branch. Some allow retirement papers to be dropped 14 months in advance, others up to 2 months before the retirement date.)

3-6 months before retirement:

Schedule your mandatory final medical and dental exam no later than 90 days before you separate.

Schedule your final PCS. This can be any time from the date your retirement papers are approved (if the family moves before the service member), up until one year after your separation date. Scheduling earlier ensures you get your requested dates.

2 months before retirement: Complete final paperwork, including forms for VA benefits, retirement benefits, and updated insurance information.

Day of retirement: Out-process, receive new retiree ID.

Somewhere along that timeline, you’ll also decide where to live, what to do next, and when to buy a home.

When to buy a home during military retirement

Every service member’s timeline will be different, but if you intend to buy a home after military separation, you will want to start the process several months before your retirement date. The closing process can take upwards of 45 days, so allow at least three months to connect with a lender, get your pre-approval, find a real estate agent, house hunt, make an offer, and close on a new home.

Thankfully, you have one full year after your retirement date to complete your final PCS. So, if you don’t close on a house before you retire, there’s no need to panic.

Your military retirement pay and home buying budget

Now that military retirement is just around the corner, it’s time to create a home-buying budget for your post-military life.

Your military retirement pay is based on your rank, time in service, chosen retirement system, and other factors. You might also receive additional financial benefits, like disability pay. During pre-separation counseling, you will receive detailed compensation information.

Using your military retirement pay amount, you can create a home-buying budget. If you already have a second career lined up, you can also include that estimated income into your budget.

Most lenders say your total mortgage payment should not exceed about 25-28% of your monthly income. A mortgage lender can help you determine what you can comfortably afford.

This home buying budget will ultimately determine where you move and what kind of house you buy.

Is this your “forever home”?

Many military families make one final move after retirement and never want to move again. After all, military service members will move more in 20 years than most civilians would move in three lifetimes!

But not all military retirees are ready for that “forever home” just yet. Maybe you’re looking for something that can serve as a home base while you spend time traveling. Perhaps you have a post-military career and need a home close to your new job. Or, maybe you still have kids at home and need a home with more space.

Before you start looking for a new home, decide whether you intend to be in this location for the long haul. If so, you may want to consider a home that will remain accessible – or can be easily renovated – as you age. A home with lots of stairs, narrow doorways, and acres of land will become difficult to maneuver and maintain if you become immobile later on.

Finding a location

Finally, you get the ultimate say in where you will live! No more moves dictated by the military! The options are endless, but you probably have a few locations in mind already.

Because military retirement usually happens long before civilian retirement age, you will likely have circumstances that dictate where you will live, such as:

A second career that requires you to move to a specific location

School-age children

Family members or friends that can provide support

Of course, if you’re lucky enough for your military retirement to also be your final retirement, you can choose a location solely because it’s where you want to live.

Don’t know where to retire? Check out the 10 Best Places for Military Retirees here!

If you intend to live in this location long-term, consider access to military installations, medical facilities, and other amenities. Being close to family, friends, and other support systems is also beneficial. Most military retirees are still a long way from needing long-term care. However, considering these scenarios is still wise if you intend to stay in this home.

No matter your plans after military retirement, you should still consider the cost of living, housing prices, local economy, and other factors before choosing a location. PCSgrades provides free area guides, housing reviews, and additional information to help military service members, veterans, and retirees make informed decisions.

Accessing your military retiree benefits

As a military retiree, you have access to hundreds of incredible benefits, including those designed to make purchasing a home easier.

You can use one such benefit, the VA loan, after separation. The VA loan is a government-backed loan program that helps service members, veterans, and retirees purchase a home with as little as $0 down. VA loans often have lower interest rates than conventional mortgages, making homeownership more affordable.

You can start the home buying process as soon as you decide to separate or retire. Even if you’re months away from putting on that uniform for the final time, you can still contact a military-friendly lender and start the process.

Access vetted and reviewed military-friendly mortgage lenders here.

If you intend to use a VA loan, it’s crucial to find a lender who is familiar with the VA loan process. This lender can walk you through your home buying options, giving you a clearer picture of what you can afford post-retirement.

You can also fill out initial paperwork and get pre-approved for a mortgage. Once you have this pre-approval, you can start looking for the perfect home. Pre-approval will allow you to quickly make an offer on a home if you find something you love.

Finding a military-friendly real estate agent

After you connect with a lender – or even before you complete your loan application – find and interview several military-friendly real estate agents at your new location. Interviewing agents allows you to get a feel for their personality, learn more about their expertise and background, and decide which agent is the best fit for your home-buying needs.

Once you hire an agent, it’s time to look for that perfect house. Real estate agents who work with military families understand our unique challenges. They’re pros at helping buyers from out of state find the ideal home, even if you aren’t able to tour the home in person. Plus, these agents can help connect you with local resources to make your home-buying experience even easier.

Start by searching our database of trusted, highly reviewed real estate agents and get up to $7,500 cash back at closing!

Before you know it, you’ll be taking off those boots for the last time, loading up the moving van, and heading off to your new life – and your new home – in military retirement.