Military Retirement: Your Military Retiree Pay Explained

by Becca Stewart - November 1st, 2022

Financial security is one of the biggest concerns for military retirees. We’re breaking down the military retirement system and helping you understand military retiree pay.

Your military retiree pay explained

Once you lace up those boots for the last time, what can you expect from those paychecks?

Your military retiree pay varies based on when you joined and which retirement system you have. There are four main military retirement systems, and the service member will only use one of them, depending when they joined and how long they have served:

1. Final Pay for retirees

The Final Pay retirement option is for retirees who joined military service prior to September 8, 1980. Under this system, those who served at least 20 years are eligible. The monthly payment is calculated using 2.5% times the number of years in service, then applying that percentage to the final base pay amount.

For instance, a service member retiring after 20 years would receive 20 X 2.5% of their base pay, or 50%. Those who served 30 years get 75%, and 40 years in service equals 100% of their final base pay.

2. High 36

The High 36 retirement system is for service members who entered between September 9, 1980, through July 31, 1986. Like the Final Pay system, retirement amounts are calculated by 2.5% times the number of years in service.

However, High 36 calculates payments by averaging the service member’s last three years’ monthly pay.

You can learn more about the Final Pay and High 36 payments and find a retirement calculator at Military OneSource.

3. REDUX

The Career Status Bonus/REDUX (CSB/REDUX) system is for service members who joined between August 1, 1986, and December 31, 2017. These service members are eligible for either the High 36 system OR the REDUX system.

The CSB/REDUX retirement system also bases its monthly payments on the last 36 months of military pay. But unlike the High 36, service members will receive a one-time $30,000 bonus at the 15-year mark. Then, the retirement percentage is reduced by 1% for each year of service under 30 years.

For example, if the member serves 20 years, the service member receives 40% of their base pay:

20 years’ service = 50% of base pay under High 36, minus 1% for each year under 30 years (an additional 10% reduction) = 40% of base pay total. Remember, this service member would still receive a one-time bonus at the 15-year mark.

The reduction does not apply to service members who serve more than 30 years.

Veterans planning for retirement can read about all the options and best practices here.

4. Blended Retirement System (BRS)

Service members who joined prior to 2006 remain in the legacy retirement system. However, those who joined between 2006 to January 1, 2018, had the option to either remain in their current military retirement system or opt into the new Blended Retirement System (BRS).

Those who joined after January 1, 2018, are automatically enrolled in the BRS.

The BRS combines a traditional military retirement pay structure plus government-matched investment opportunities via the Thrift Savings Plan (TSP), similar to a civilian 401(k).

Under this system, payments equal 2% times the number of years in service. So, those who serve 20 years will receive 40% of their 36-month average base pay. Those who serve 25 years will receive 50%, and so on.

Additionally, those in the BRS can receive a one-time continuation pay at 12 years of service (with additional service requirements).

The most significant change under the BRS is the TSP, which allows service members to invest in a retirement account, whether or not they retire from the military. Those who serve five or ten years will still have something invested toward retirement, even though they won’t qualify for traditional military retirement.

The government will automatically add 1% of the service member’s base pay into the TSP. After two years of service, the government will match up to an additional 4% of total contributions. If a service member contributes 5% of their base pay into the TSP, the government will match, adding up to a 10% total contribution. Over time, and with compound interest, that investment can grow significantly.

To calculate your earnings under BRS, visit the Military OneSource website here.

Additional military benefits for retirees

In addition to retirement pay, some veterans and retirees will also qualify for disability payments. These payments vary based on the service member’s disability percentage.

Disability benefits can also reduce total tax burdens for military retirees. Click here to read more about tax advantages for military retirees.

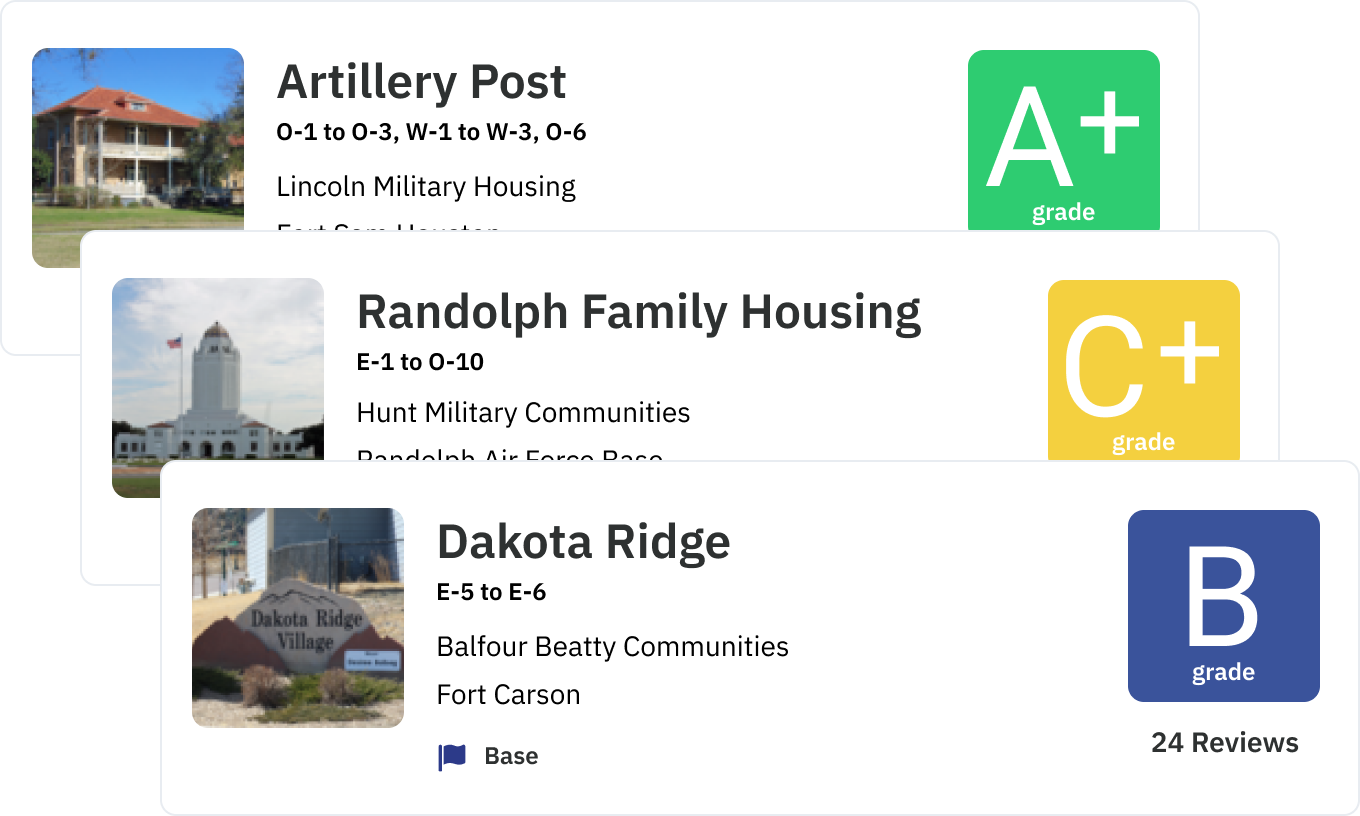

This article has tips on deciding where to live after military retirement.

A second career after military service

For many military families, military retirement pay will not cover necessary expenses. The service member will seek a second career after military service to stay financially solvent. Military retirement pay, in addition to TSP earnings if in the Blended Retirement System, can create a substantial financial safety net while you look for another career.

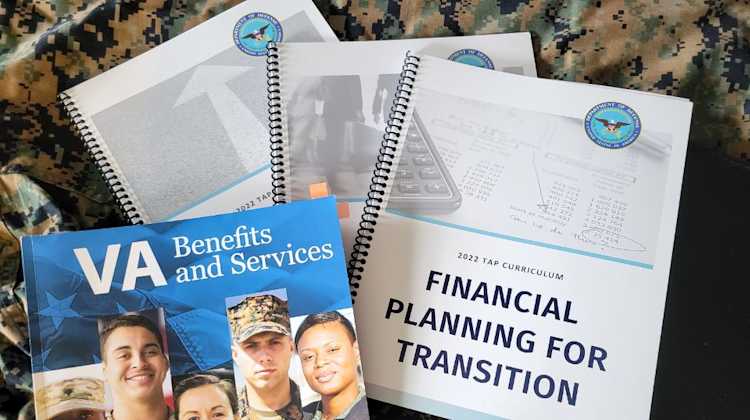

Attending a Transition Assistance Program (TAP) seminar before retirement is an excellent way to explore education and career opportunities outside the military.